VUSO Insurance Company – all information – Ministry of Finance

VUSO Insurance Company is registered in the Bahamas and is an indirect wholly owned subsidiary of the Ministry of Finance. VUSO offers a range of insurance products to individuals, businesses, and government entities. We provide products and services through our direct-to-consumer platform as well as through our network of agents. We have a long history of providing quality products and services to our customers. To learn more about VUSO and our products, visit our website or contact us today.

VUSO Insurance Company is a wholly owned subsidiary of the Ministry of Finance.

VUSO Insurance Company

VUSO Insurance Company is a Mauritian company that offers insurance products and services to the Mauritian population. The company was founded in 1984 and is headquartered in Port Louis. VUSO Insurance Company has subsidiaries throughout Mauritius, including its head office, an advisory subsidiary, and six regional offices. As of December 31, 2017, the company had 1,324 employees and total assets of Rs. 916 million (USD $136 million). VUSO Insurance Company offers a range of insurance products and services, including life insurance, health insurance, property insurance, vehicle insurance, pet insurance, and travel insurance. In addition to traditional products and services offered by most insurers, VUSO Insurance Company also offers specialty products such as disability insurance and motorcycle safety insurance. The company’s goal is to provide affordable coverage to the Mauritian population while providing quality service.

VUSO Insurance Company is a privately held insurance company headquartered in Toronto, Canada. The company provides general insurance, life insurance, and vehicle insurance products to consumers and businesses in Canada.

VUSO Insurance Company was founded in 2003 by CEO Jim Balsillie and Chairman Allan Rock. The company operates through two divisions: General Insurance and Life Insurance. VUSO General Insurance offers a wide range of products including automobile, home, boat, motorcycle, pet, travel, health and life insurance. VUSO Life Insurance offers products such as termlife, universal life, universal death benefits, and endowment plans.

In 2007, VUSO acquired Dominion Financial Planning Corporation (DFPC), a Canadian financial planning firm with over $500 million in assets under management. The acquisition strengthened the company’s reach into the personal financial services market and expanded its product offerings to include wealth management services.

In 2009, VUSO entered into an agreement with Allianz Global Investors whereby the two companies would partner on marketing initiatives aimed at attracting new business customers to Allianz’s mutual fund lineup. Under the agreement, Allianz would provide lead generation services for VUSO’s mutual fund offerings while VUSO would promote Allianz’s funds through its own channels including website content and advertising campaigns targeted at Canadian investors.

In 2010, Vuso partnered with TD Bank Group to create TD Wealth Solutions Canada Ltd., a joint venture that provides investment advice and

History of VUSO Insurance Company

VUSO Insurance Company is a state-owned enterprise controlled by the Ministry of Finance. It was founded in 1991 and has since become one of the leading insurance companies in Uruguay.

VUSO is registered with the Uruguayan Securities Market Commission (CMU). As of December 31, 2016, it had total assets of UGX 1,332 million and total liabilities of UGX 1,533 million. The company’s main lines of business are property and casualty insurance, life insurance, and retirement income products. VUSO also offers reinsurance services.

In 2006, VUSO received a Presidential Award for Excellence in Financial Services. In 2009, it was ranked number one in Uruguay by Interamérica World Research Institute (IWRI) in its “An Overview of Latin American Insurance Markets” report. In 2013, it was again awarded the Presidential Award for Excellence in Financial Services.

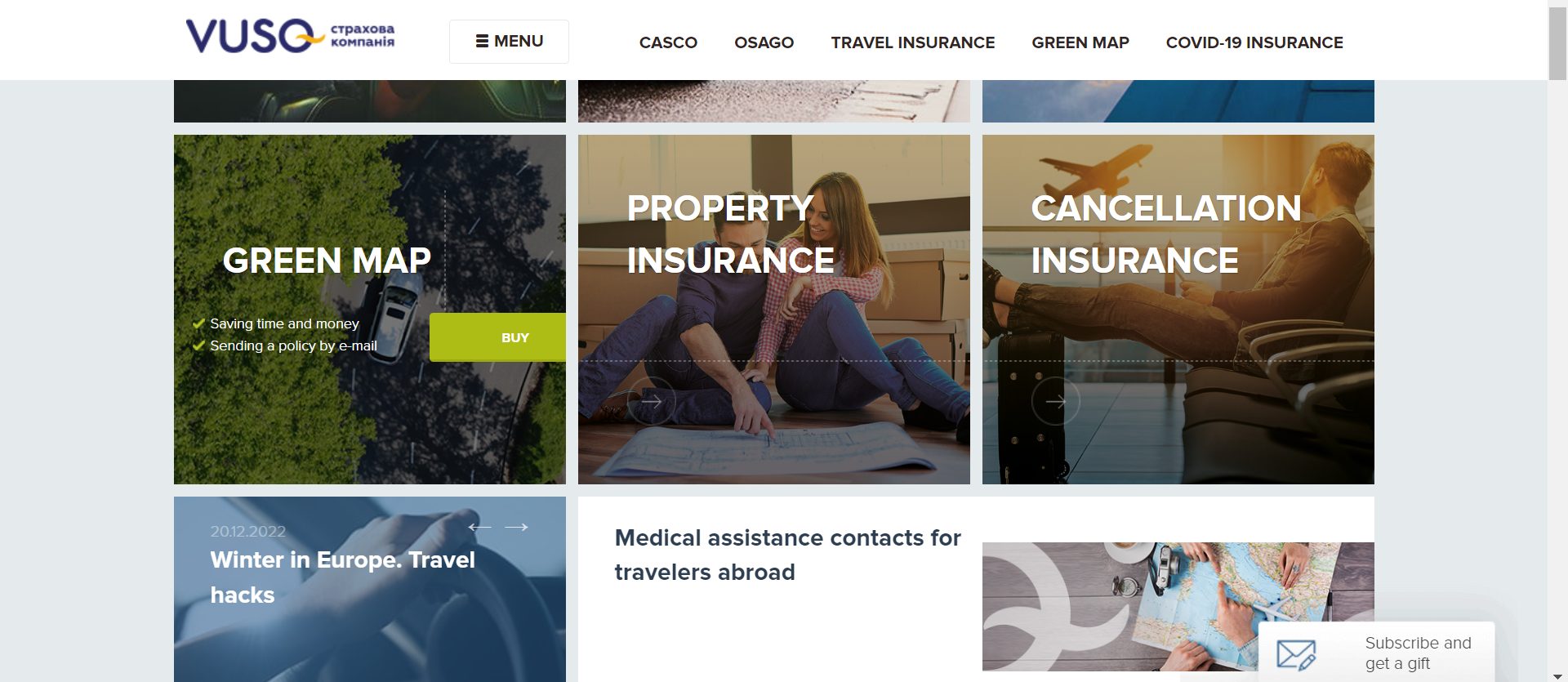

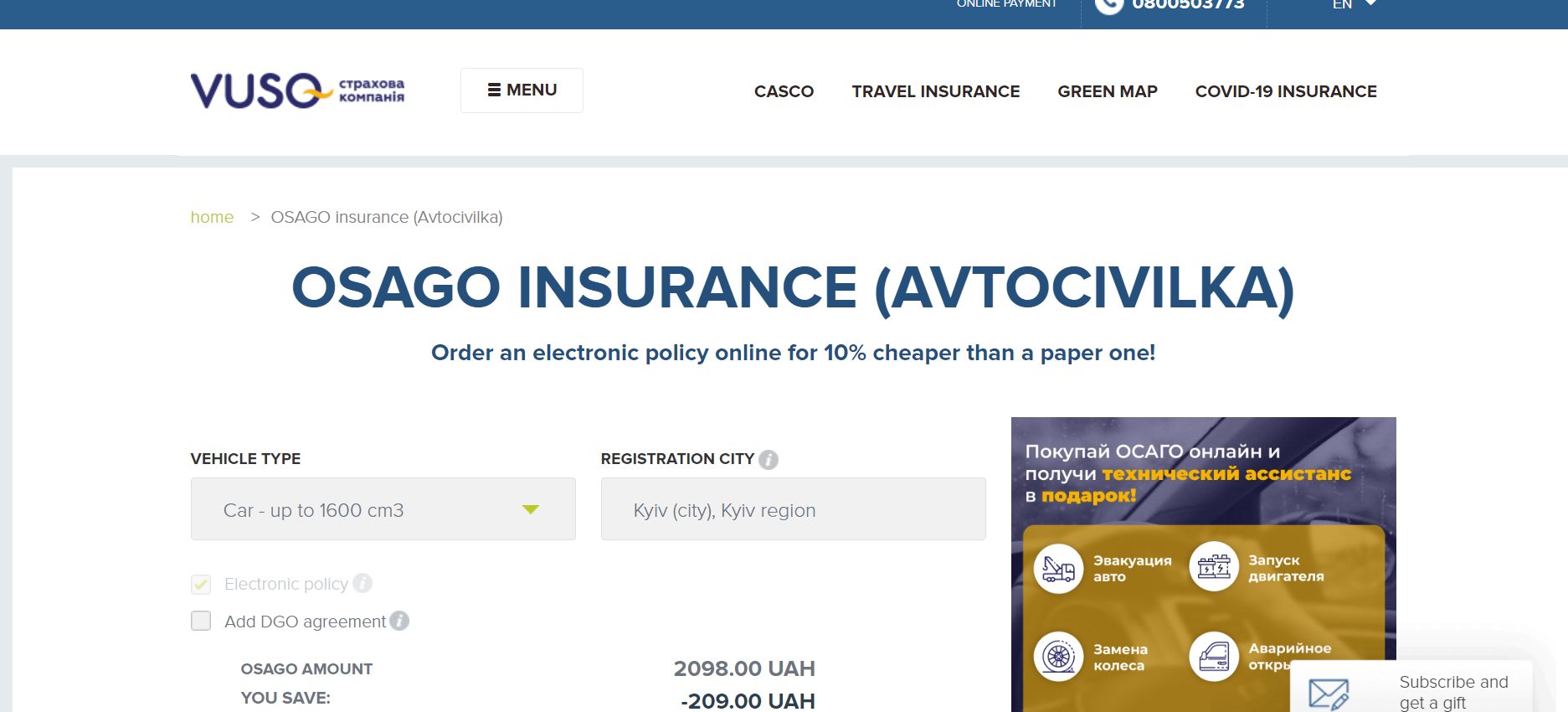

Products and Services

VUSO Insurance Company is a specialized insurance company that offers a range of products and services to businesses and individuals in Quebec. The company was founded in 1928 and has since become one of the province’s most recognized brands.

VUSO provides a full range of insurance products and services, including property, casualty, life, health, and auto insurance. In addition to its traditional product lines, VUSO also offers specialized insurance products for small businesses and entrepreneurs, as well as specialized risk management solutions for business owners.

The company’s customer service team is available 24 hours a day, 7 days a week to help businesses get the coverage they need without having to worry about any hassle or hassle. VUSO also provides easy access to online resources and tools that help business owners learn more about their insurance options and understand how those options can benefit their business.

For more information on VUSO Insurance Company or any of its products or services, please visit the Ministry of Finance’s website or contact the company directly at 1-800-267-5669.

Corporate Governance

Corporate governance is the framework within which a company is operated. This includes the principles of management, board composition and responsibilities, financial reporting, investor relations, and other controls that help ensure the company is run in a responsible and sustainable manner.

VUSO Insurance Company is registered with the Ministry of Finance as a limited liability company. It was founded in 1987 and operates as an insurance broker and distributor. Its core products include life, health, property, auto and motorcycle insurance. VUSO employs over 200 people in its offices in Ontario, Quebec, Alberta and British Columbia.

The Board of Directors consists of eleven directors who are appointed by the Minister of Finance on the recommendation of the President of VUSO Inc. The Board has overall responsibility for the management and direction of VUSO while ensuring that it complies with all applicable laws and regulations. The Board meets at least four times per year to discuss matters pertaining to its mandate.

The Chief Executive Officer leads VUSO’s day-to-day operations while reporting directly to the Board. The CEO has experience in both private industry and government service where he has held positions including President & CEO at two different public companies. Mr. Farmer also holds a Master’s degree from Queen’s University in Business Administration

Financial Statements and Reports

Financial Statements and Reports:

VUSO Insurance Company was incorporated in the year 2001 with an authorized capital of Rs 10 Crores. The company provides insurance products and services to small-scale businesses and farmers. In Fiscal Year 2017-2018, VUSO had earned a net profit of Rs 2.30 crore on a consolidated basis. During the same period, the company incurred losses of Rs 1.90 crore on general insurance products offered to SMEs and farmers.

VUSO Insurance Company is a public limited liability company, established in Latvia on January 26, 2009. The company’s registered office is at Daugavpils, Latvia.

The company is engaged in the business of insurance, reinsurance and investment activities. As of December 31, 2016, the company had total assets of EUR 454 million and total liabilities of EUR 276 million. VUSO Insurance Company’s shareholders are the State Treasury (49%), Eiropas Savienības Banka (16%) and Bank of America Merrill Lynch (15%).